Premier Energies Ltd, a leading manufacturer of integrated solar cells and solar panels, recently concluded its highly anticipated Initial Public Offering (IPO). The IPO, which opened for subscription on Tuesday, August 27, 2024, and closed on Thursday, August 29, 2024, generated significant interest from investors across different categories. The Hyderabad-based company’s IPO was oversubscribed by more than 74 times, reflecting strong demand from both institutional and retail investors.

Table of Contents

Overview of Premier Energies IPO

The Premier Energies IPO offered a total of 62,897,777 equity shares to the public, with the aim of raising substantial funds to support the company’s growth plans. The IPO was structured to cater to various types of investors, including Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NIIs), retail investors, and employees of the company. The IPO price band was set between ₹427 to ₹450 per share, and the company sought to raise a total of ₹2,830.40 crore.

The public issue included a fresh issue of 2.87 crore shares, which were expected to raise ₹1,291.40 crore. Additionally, there was an offer for sale (OFS) of 3.42 crore shares, contributing ₹1,539.00 crore to the total funds raised. The proceeds from the fresh issue will be utilized to expand Premier Energies’ manufacturing capacity, enhance research and development activities, and for general corporate purposes. The funds from the OFS, however, will go to the selling shareholders.

Subscription Details and Investor Response

The Premier Energies IPO witnessed a remarkable response from investors, particularly on the third and final day of bidding. According to data from the Bombay Stock Exchange (BSE), the IPO was subscribed 74.38 times, a clear indication of the high demand for Premier Energies shares.

QIBs Lead the Way

The portion of the IPO reserved for Qualified Institutional Buyers (QIBs) saw the highest level of interest, being subscribed a staggering 216.67 times. This overwhelming response from QIBs underscores the confidence that large institutional investors have in Premier Energies’ business model, growth prospects, and market positioning.

NII and Retail Investor Participation

The portion reserved for Non-Institutional Investors (NIIs) was also heavily subscribed, with bids amounting to 50.04 times the shares on offer. This strong participation from high-net-worth individuals and other non-institutional investors highlights the broad appeal of the Premier Energies IPO across different investor segments.

Retail investors, who were allocated 35% of the total shares, subscribed their portion 7.69 times. While not as high as the QIB or NII subscriptions, this still represents a significant level of interest, particularly considering the competitive nature of IPO investments. Retail investors were eager to participate in Premier Energies’ growth story, driven by the company’s leading position in the solar energy sector and its potential for future expansion.

Employee Participation

Premier Energies also made provisions for its employees to participate in the IPO, offering them a discount of ₹22 per equity share. The employee portion was subscribed 11.43 times, indicating strong support from within the company. This level of participation from employees reflects their confidence in the company’s future and their desire to benefit from its growth.

Premier Energies IPO Subscription Timeline

The subscription process for the Premier Energies IPO unfolded over three days, with interest building steadily each day. On the first day of bidding, the IPO was subscribed 2.17 times. This initial response set the stage for the subsequent days, as more investors became aware of the opportunity and rushed to participate.

By the second day, the subscription level had risen to 6.61 times. The IPO received bids for 29,48,83,545 shares against the 4,46,40,825 shares on offer. The strong momentum continued into the third day, culminating in the final subscription rate of 74.38 times.

Premier Energies IPO Pricing and Allocation

The price band for the Premier Energies IPO was set between ₹427 to ₹450 per share. Given the strong demand, the IPO was likely priced at the upper end of this range. Investors who participated in the IPO eagerly awaited the allotment process, which determines the final distribution of shares among the various categories of investors.

The allocation of shares is conducted based on the subscription levels in each category, with QIBs, NIIs, and retail investors receiving shares according to the number of times their respective portions were oversubscribed. Given the high level of interest, many investors, particularly retail participants, may receive fewer shares than they applied for, or none at all if the oversubscription was too high.

Book Running Lead Managers and IPO Registrar

The Premier Energies IPO was managed by some of the most prominent names in the investment banking industry. Kotak Mahindra Capital, J.P. Morgan India, and ICICI Securities were the book running lead managers for the IPO. These institutions played a critical role in managing the IPO process, from setting the price band to ensuring compliance with regulatory requirements and coordinating the subscription process.

Kfin Technologies Limited was appointed as the IPO registrar. As the registrar, Kfin Technologies was responsible for processing the applications, finalizing the share allotment, and handling any post-IPO issues that investors might encounter.

Premier Energies: A Leader in the Solar Energy Sector

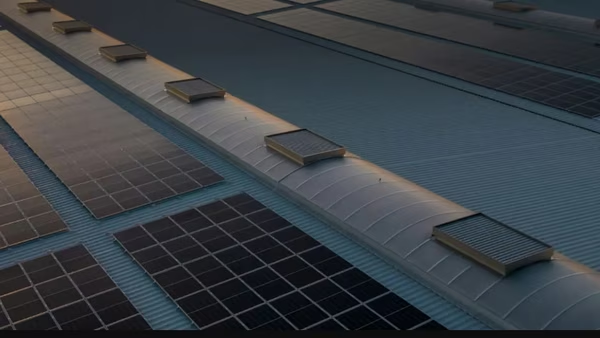

Premier Energies Ltd has established itself as a leading player in the solar energy industry in India. The company specializes in the manufacture of integrated solar cells and solar panels, which are essential components in the production of solar energy. With a strong commitment to innovation and sustainability, Premier Energies has positioned itself as a key contributor to India’s renewable energy goals.

The company’s products are in high demand both domestically and internationally, as more countries and businesses seek to transition to cleaner energy sources. Premier Energies’ manufacturing facilities are equipped with state-of-the-art technology, enabling the company to produce high-quality solar products that meet the stringent requirements of global markets.

Growth Prospects and Strategic Plans

The funds raised from the Premier Energies IPO will be instrumental in supporting the company’s ambitious growth plans. Premier Energies aims to expand its manufacturing capacity to meet the growing demand for solar energy products. This expansion will not only increase the company’s production capabilities but also enable it to capture a larger share of the market.

In addition to capacity expansion, Premier Energies plans to invest in research and development (R&D) to further enhance the efficiency and performance of its solar products. By staying at the forefront of technological advancements, Premier Energies can continue to offer cutting-edge solutions to its customers, ensuring long-term competitiveness in the market.

The company also intends to use a portion of the IPO proceeds for general corporate purposes, which may include debt repayment, working capital needs, and other operational expenses. This financial flexibility will allow Premier Energies to navigate market fluctuations and seize new opportunities as they arise.

Conclusion: A Successful IPO and a Bright Future

The Premier Energies IPO stands out as a significant success, attracting strong interest from a diverse group of investors. The oversubscription of 74.38 times is a testament to the confidence that investors have in the company’s future prospects and its leadership in the solar energy sector.

As Premier Energies moves forward with its growth plans, the funds raised from the IPO will play a crucial role in driving its expansion and innovation efforts. With the backing of institutional and retail investors alike, Premier Energies is well-positioned to capitalize on the increasing demand for renewable energy and to continue its leadership in the solar industry.

The successful conclusion of the Premier Energies IPO marks the beginning of a new chapter for the company, one that is poised for continued growth and success in the years to come.